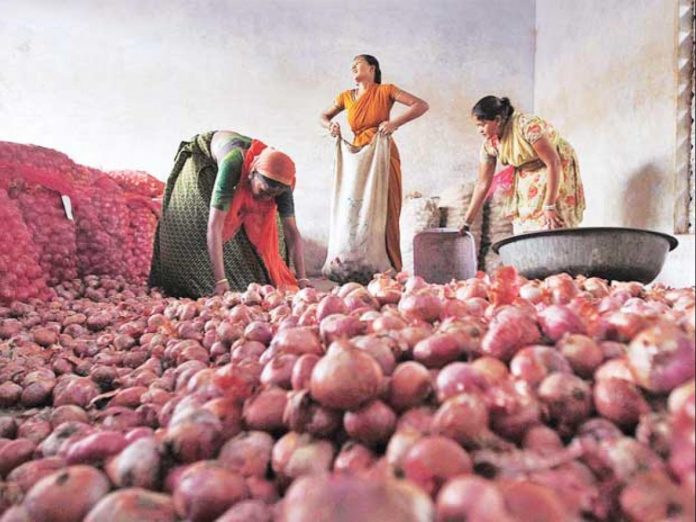

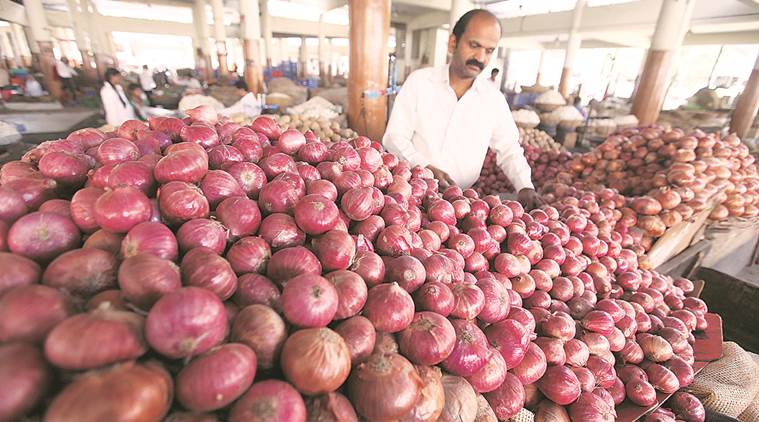

With the price of onion rising almost 30 per cent in two days, to touch the the highest since September 2015, traders fear the government will move swiftly to ban exports. Last week’s measures to curb prices, such as the levy of minimum export price (MEP) and permission for duty-free import failed to curb the price rise.

When onion shot up to Rs 32 a kg on September 13 in the benchmark Lasalgaon mandi, Asia’s largest market yard for the bulb, the government imposed an MEP of $850 a tonne and allowed duty-free imports of 2,000 tonnes of the vegetable. Since then, however, onion prices have surged by 39 per cent to trade today at Rs 44.50 a kg in the Lasalgaon mandi in Nashik, Maharashtra. The current wholesale price is the highest in four years. Yesterday, prices jumped to Rs 45 per kg from Rs 33 a day earlier.

The bulb is quoted at Rs 65 a kg in the Delhi retail market, 56 a kg in Kolkata and Rs 50 a kg each in Mumbai and Bengaluru. Retail prices have surged by up to 67 per cent in the first three weeks of September.

This means, the government’s measures so far have not helped cool down onion prices, due probably to a sharp increase in demand for the bulb from local markets, delay in the new early-variety crop arrivals and reports of crop damage due to excessive rainfall.

“The actions taken so far to cool down onion prices have not worked. There is an actual shortage of onion in the market. Local demand has surged due to the festive season ahead. Demand from overseas has also perked up with many exporters having opened letters of credit (L/Cs) at $850 FOB (free-on-bard). Now, traders are afraid of a possible ban on onion exports,” said Sanjay Sanap, an onion stockist at Nashik.

Interestingly, onion shot up to dirham 2.80 a kg, or about Rs 50.50 a kg in the Middle East today. Prices have risen by 20-25 per cent in that market the past 10 days.

Meanwhile, early crop arrivals from Andhra Pradesh and Karnataka, which normally begin in full swing by mid-September, are delayed due to excessive rainfall and crop damage in these states. While sporadic arrivals have begun, the quantity is inadequate to meet India’s rising festival demand.

“Major mandis in Nashik had a cumulative arrival of around 2,500 tonnes a day, which is around 40 per cent lower than the demand for the bulb in these mandis. So, price rise is purely based on lower arrivals,” said Narendra Savaliram Wadhavane, Secretary, Agricultural Produce Market Committee (APMC), Lasalgaon.

In Lasalgaon mandi, however, total arrivals declined to 1,080 tonnes on Friday as compared to 1,200 tonnes a week ago, and 2,545 tonnes a month ago.Traders estimate only 20 per cent of stock is left with farmers and stockists, which is insufficient to meet the demand till the new season crop arrives by October-end.

“The current price level is likely to continue for four to six weeks. But, any further sharp increase in onion prices from the current level is highly unlikely,” said Wadhavane.

India exports onion to Bangladesh, Sri Lanka and the Middle East. But Pakistan has also emerged as a large importer of onion this year. While Turkey has started supplying to Pakistan, Bangladesh, Sri Lanka and the Middle East continue to import from India, despite the price rise and MEP levy over quality.Sanap said that the ban on exports would prove counterproductive when the new season supply hits mandis.